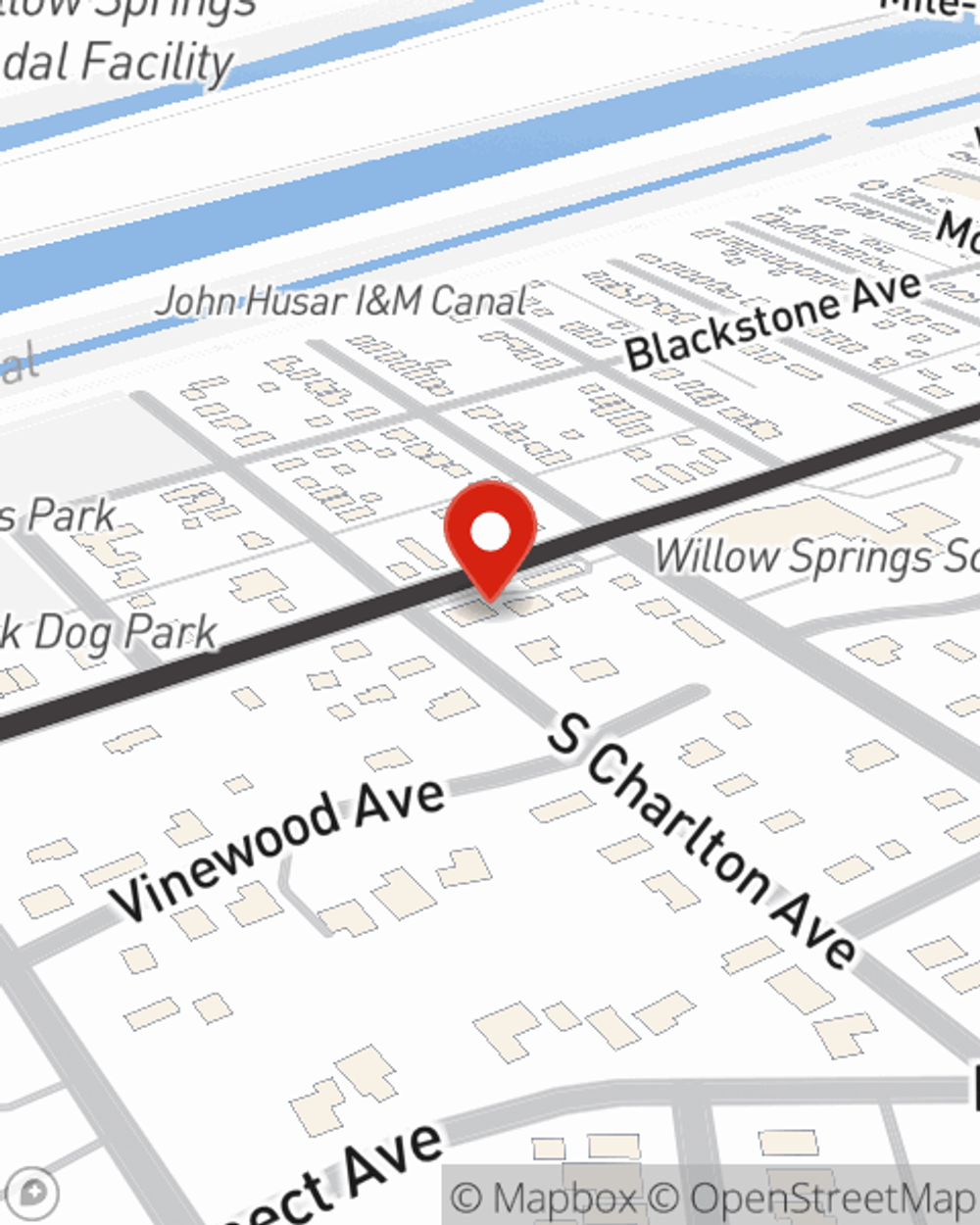

Renters Insurance in and around Willow Springs

Willow Springs renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your rented condo is home. Since that is where you kick your feet up and make memories, it can be a wise idea to make sure you have renters insurance, whether or not your landlord requires it. Even for stuff like your coffee maker, pots and pans, microwave, etc., choosing the right coverage can insure your precious valuables.

Willow Springs renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a property or home, you still own plenty of property and personal items—such as a a video game system, couch, coffee maker, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Barbara Murray? You need an agent with a true desire to help you evaluate your risks and examine your needs. With skill and personal attention, Barbara Murray stands ready to help you keep your things safe.

Reach out to Barbara Murray's office to see how you can save with State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Barbara at (708) 423-5900 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Barbara Murray

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.